Consider this before buying your first home

A few things you should know about Canada's First-Time Home Buyer Incentive and what it means for you.

We all need to live somewhere! But whether that somewhere is a rental, or your very own home sweet home all depends on your personal preferences and financial situation.

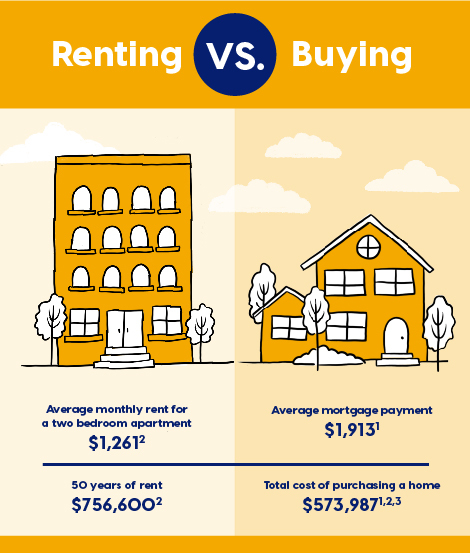

There are pros and cons to both renting and owning, so we ran some numbers to give you a better idea of what each option means for your finances.

Do you remember what your first apartment was like? Chances are you had just moved away from home, and it was a shared space with at least one roommate… and all their dirty dishes. Renting is a great option when you’re just starting out—it offers the flexibility and freedom of your own space without some of the responsibilities that come with home ownership. Plus, saving up for a down payment doesn’t happen overnight, so renting is an inevitability for a lot of people.

But renting isn’t just for those of us in our early 20s. Regardless of your age, life position, or financial situation it can be nice to know that when something breaks, all you need to do is pick up the phone and it becomes somebody else’s problem to deal with.

After paying for somebody else’s mortgage for a while, it might be nice to start thinking about saving up for your own home. You will need to shell out some money every month toward your housing costs, so it might as well be going toward your own investment. And that’s one of the main advantages to owning a home: your monthly payments are going toward an asset that is yours.

There’s no question that a home is a big investment, but it’s also a big investment in your future. And it means you have the freedom to make changes. Thinking about changing your paint colour? Go for it. Considering adopting a dog? No problem!

Of course, when something breaks, you’re on the hook to fix it, and there’s also property taxes, regular maintenance, and utilities to keep in mind. But with a bit of planning, you can stay on top of those extra expenses.

And if the numbers feel you leaving confused, that’s ok. Your local credit union is here to inform and support you on your journey to find your next home.

1 Based on average Atlantic Canadian home price of $339,916 in 2021 and the minimum 5% down payment and an interest rate of 4.79% (which is used as a qualifying rate–actual mortgage rates may be lower) amortized over a 25-year period. This also includes the default insurance premium being rolled into the mortgage. The actual mortgage payment will depend on the size of the down payment along with the amortization.

2 The calculations above do not account for inflation, which is on average 3% per year.

3 Accelerated bi-weekly or weekly payments along with options to make lump sum payments or ability to increase payments could impact this final number. A larger down payment would also change the numbers above.